REGULATOR

ACS is regulated by the FCA and follows Information Commissioner Office (ICO), Financial Conduct Authority (FCA) and Financial Ombudsman Service (FOS) guidelines.

The FCA is an independent non-governmental body, given statutory powers by the Financial Services and Markets Act 2000. The FCA set out the rules for how firms must deal with complaints. These are contained in the FCA handbook under subsection DISP.

The Financial Ombudsman Service was established in 2000, and given statutory powers in 2001 by the Financial Services and Markets Act 2000.

DEFINITION

From the Financial Services and Markets Act 2000 the FCA and FOS developed standards and rules with regards to how businesses respond to complainants and ensure they are treated fairly.

WHAT IS A COMPLAINT?

‘Any expression of dissatisfaction by a customer, insurance company, referrer, or any other person concerning Active Claims Solutions, behaviours, actions or attitude of an employee within the group’

According to FCA DISP 1.3.1a all complaints can be made free of charge.

WHAT IS A JUSTIFIED UNREOLVED COMPLAINT?

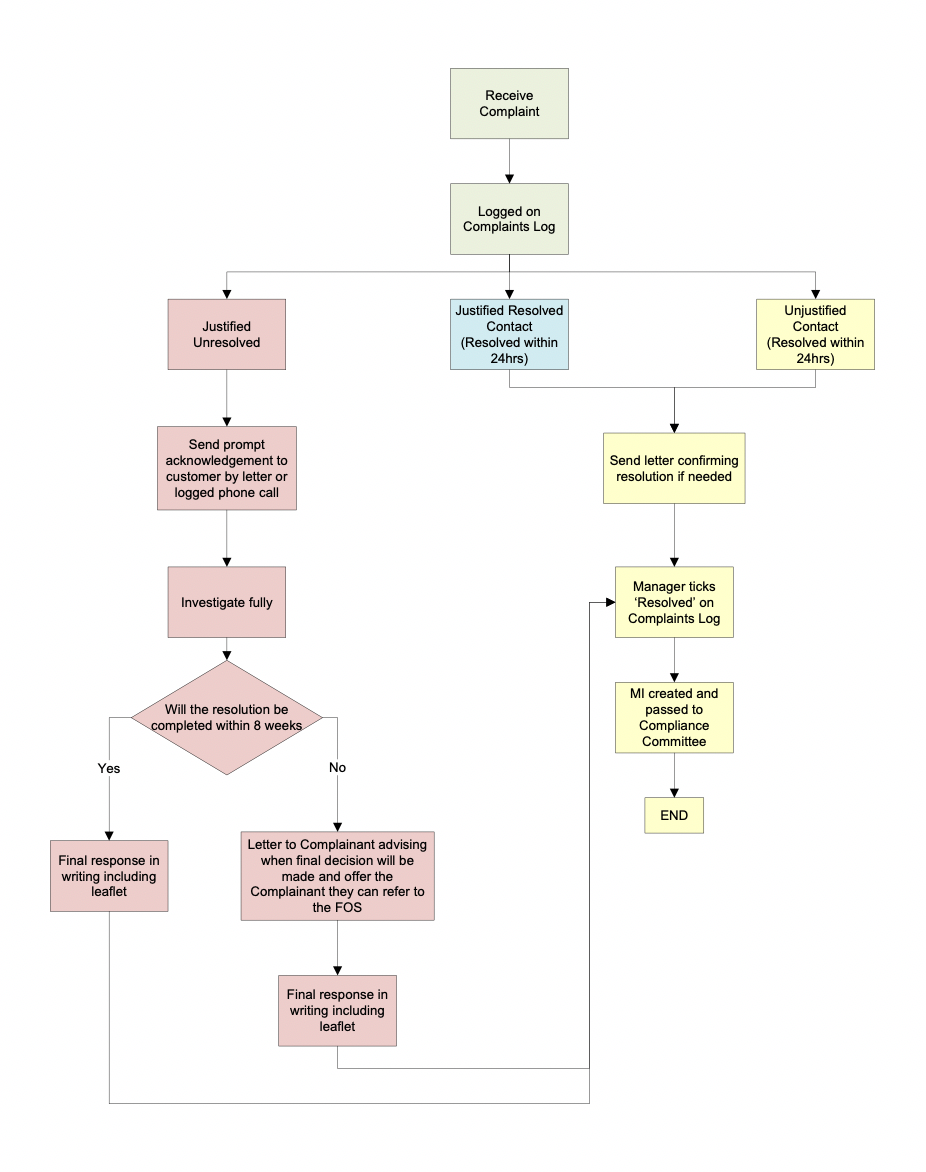

A justified unresolved complaint is a structured specific complaint with reasonable grounds for ACS to be solely or jointly responsible for the matter alleged in the complaint taking into account all relevant factors. This complaint was unable to be resolved immediately and therefore require an investigation and written outcome within an 8 week’s timescale.

WHAT IS A JUSTIFIED RESOLVED CONTACT?

A justified resolved contact complaint is a structured specific complaint with reasonable grounds for ACS to be solely or jointly responsible for the matter alleged in the complaint taking into account all relevant factors. This complaint was resolved within 24 hours and does not require further investigation.

WHAT IS AN UNJUSTIFIED CONTACT COMPLAINT?

An unjustified contact complaint is a general complaint with no reasonable grounds for ACS to be solely or jointly responsible for the matter alleged in the complaint. This complaint was resolved within 24 hours and does not require further investigation.

ACS RESPONSIBILITIES

Active Claims Solutions follows the FCA DISP 1.2.1 publishing appropriate information regarding the internal transparent procedures for the reasonable and prompt handling of any complaints and ensuring that a written final response is provided to all complainants. ACS Directors are responsible for monitoring and resolving complaints, with the Compliance committee responsible for ensuring that all complaints met the FOS and FCA standards.

STAFF RESPONSIBILITIES

All ACS staff must log any expressions of dissatisfaction accurately on the internal CRM complaints log and try to resolve complaints themselves at first contact. If they are unable to do so to the client’s satisfaction then the complaint must be logged and passed to a department manager to investigate as per the complaints resolution process.

HOW DOES ACS RECEIVE COMPLAINTS?

Complaints or expression of dissatisfaction whether justified or not, can be received written or oral:

Letter

Fax

Telephone

In Person

Via customer/company representative

HOW ARE COMPLAINTS RECORDED?

ACS complaints are logged on an internal system. The complaints are monitored weekly by the ACS Directors who are responsible for monitoring and resolving complaints. On a monthly basis the Directors collate all the complaints information and these are reviewed quarterly by the Board to identify if significant changes are needed in the operations of the company.

TIMESCALES

In accordance with FCA ruling and the FOS all ACS complaints must be resolved and a final response letter sent to the complainant within 8 weeks from receipt of the initial complaint. If for some reason ACS requires an extension of this timescale then a written request for extension must be sent to the complainant advising why they are not in the position to make a final decision within the 8 week timescale and offer an indication of when they can expect a final response.

If an extension of the 8 weeks is required ACS must also advise the complainant that they can now refer to the Financial Ombudsman Service if they would like and enclose a leaflet advising how to do so.

WHAT IS A FINAL RESPONSE?

A final response to a consumer’s complaint should be in writing and should include the following:

Give a summary of the complaint, setting out the outcome of the investigation and ACS final view on the issues raised

Advise whether ACS acknowledges any fault on the part of the company

Details of any offer to settle the complaint

Enclose the Financial Ombudsman Services leaflet

Offer the customer their right to dispute ACS decision to the Financial Ombudsman Service within 6 months, if they are unhappy with our response.

CAN THE COMPLAINANT APPEAL THE FINAL DECISION AND IF SO HOW?

The complainant has the right to dispute ACS’s decision to the Financial Ombudsman Service within 6 months, if they are unhappy with the response. A leaflet of how to do so will be sent to the complainant with the final response letter.

DOES ACS OFFER COMPENSATION FOR A COMPLAINT?

Any complaint, where the complainant has suffered a loss or damages due to the actions or service by Active Claims Solutions, we will investigate the claim for redress or loss and we will offer compensation where we feel ACS has been negligent in our operations and we feel it fair and reasonable for the claim to be made.

There may be cases where alternative compensation is made as a ‘gesture of good will’ these gestures will only be made by instruction of the Operations Director.

TREATING CUSTOMERS FAIRLY

Treating customers fairly is an essential element of all areas of the business and fair and consistent complaints handling gives ACS an opportunity to ensure we are meeting and managing our client and customers experiences and expectations of the services we provide.

Following FCA complaint resolution rules 1.4.1, once a complaint has been received ACS will investigate the complaint competently and impartially ensuring the assessment is fair, consistent and prompt, considering if there are reasonable grounds for ACS to be solely or jointly responsible for the matter alleged in the complaint taking into account all relevant factors.

PENALTIES

According to FCA ruling if there are more than 500 complaints in 6 months then ACS must declare this and add to their website.

According to DISP 3.7.4 the maximum money award which the Financial Ombudsman Service can make is £350,000 for a complaint concerning an act or omission which occurred on or after 1 April 2019.

WHAT HAPPENS IF A COMPLAINT IS TAKEN TO THE FINANCIAL OMBUDSMAN?

If a complaint is referred to the Financial Ombudsman, ACS will cooperate fully and comply promptly with any settlements or awards made by it.

HOW DOES ACS USE COMPLAINTS TO OUR ADVANTAGE?

ACS appreciates any feedback about their service and by reviewing each complaint are able to identify the root cause of the issues and try to avoid any reoccurrence in complaint types.

All complaints are reviewed quarterly by the ACS Directors to identify if significant changes are needed in the operations of the company.

DOES ACS CONDUCT CUSTOMER SERVICE SURVEYS?

Active Claims Solutions send customer service surveys to random clients by use of email mail shot and telephone, these surveys ensure that Active Claims Solutions are operating & providing the service our customers expect. It also gives ACS the opportunity to establish any dissatisfaction in our service that had not previously been raised by the client.

COMPLAINTS RESOLUTION PROCESS